As a part of the shopping journey, payments have traditionally been seen as an impediment to the consumer. Waiting in line, friction at the point of checkout or lack of the preferred payment method are among the challenges consumers face. Thankfully, with the arrival of PSD2 and Open Banking, those days are gone. Now it is time for the payments process to take a leap forward and turn into a genuine frictionless enabler in the purchasing experience.

The attempt by the European lawmakers to facilitate the creation of a new ecosystem to drive competition and innovation in the European payments market through PSD2 was orchestrated to bring cheaper products to benefit consumers, corporates, and the European economy in its entirety. Starting with January 13, 2018, European banks have been opening up their APIs to communicate with third party providers (TPPs) enabling them to access the customer data they need to build value-adding services. This way, PSD2 ends banks’ monopoly on customers’ account information and payment services and paves the way to numerous types of services built on top of the customer’s account. Previously, access to bank accounts was possible for the account issuer or unregulated providers using screen scraping and consumer security credentials. Under PSD2, any regulated third party can access a consumer’s bank account with the consumer’s consent. Via a single platform, customers can access multiple financial services, all integrated with their existing account and transactional data.

The services offered by TPPs, namely payment initiation services (PIS) and account information services (AIS), are not entirely new; for example, PayPal has been offering something similar for quite a while. Therefore, PSD2’s role is to make these business models more attractive and stimulate consumer’s trust by strictly regulating the new services.

The possibilities of utilizing PIS and AIS

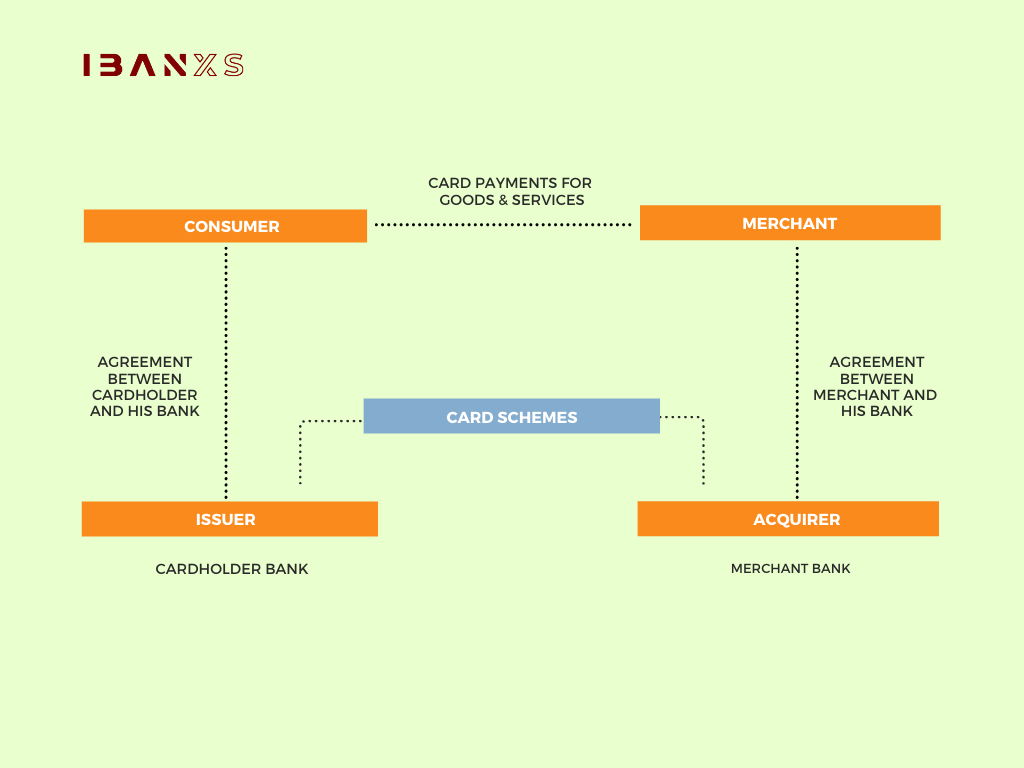

To better understand where TPPs – PISPs and AISPs – stand in the value chain, we must go back to the Four Corner Model. Here, the parties (the issuer, acquirer, consumer, and the card network) are involved in the exchange of transaction information, card networks having their role in card information exchange, clearing, and settlement. To enter this ecosystem, PISPs and AISPs must connect with the consumer to get consent and collect data regarding identity and account details, and must access the consumer’s bank to initiate the payment from their account or render valuable account data. TPPs have fee-free access to the payer’s payments account, meaning a cost advantage over payment methods that are based on interchange fees. However, the benefits go beyond that, and we have summarized them in this series of articles.

Payment Initiation Services

Benefits for merchants

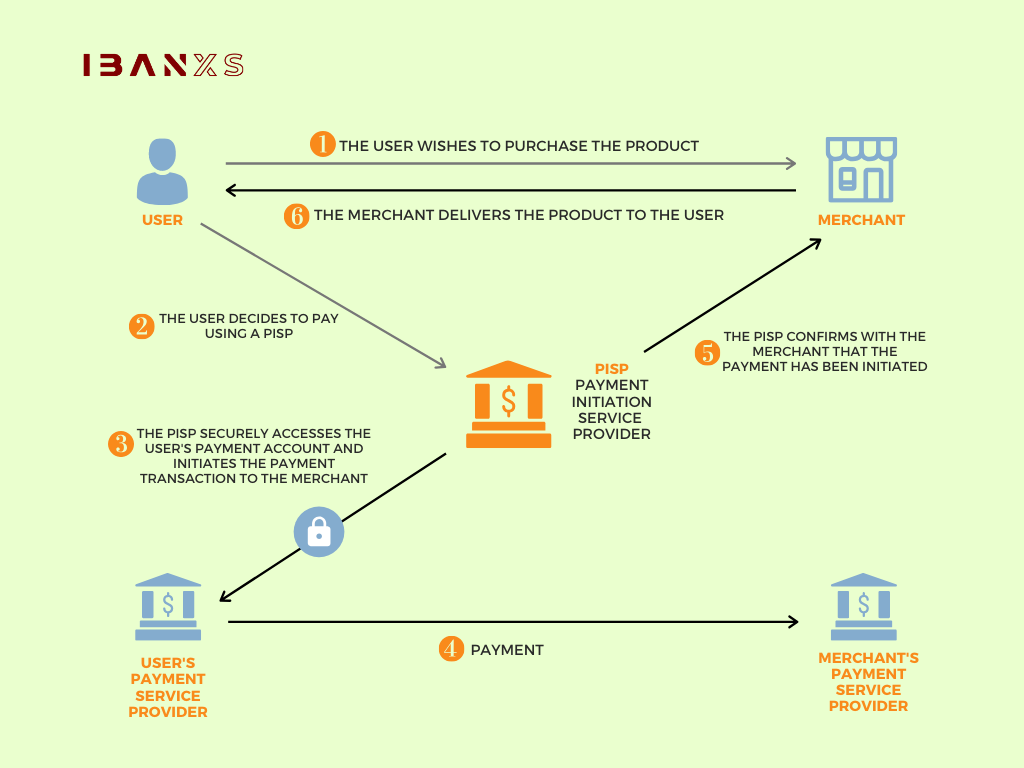

One of the most important benefits for merchants is the ability to complete account-based payments directly and securely, which comes with multiple other advantages. Through a PISP, the intermediary previously engaged in the payment value chain (the card network) is eliminated, which means a cost reduction for the merchant (a cost that is associated with card-based payments, checks or paper invoicing).

For merchants that need to fulfill orders immediately, a direct bank payment is the best choice. They can receive a notification from their payment provider allowing them to release goods or services, as they are certain that the funds will settle. As the PISP communicates directly with the account holder’s bank, the merchant is provided with instant confirmation of transactions and even settlement when the account holder’s bank is connected to an instant payments scheme (like the EPC SEPA Instant Credit Transfer – SCT Inst scheme). The instant confirmation comes with additional benefits, minimizing the risk of chargebacks, one of the merchant’s biggest pain points when it comes to payments.

When thinking of enriching their payment solution, implementing loyalty schemes or even offering personalized offerings based on consumer habits, merchants can greatly benefit from the services offered by PISPs. To support P2P payments, for example, the PISP could offer the payers the possibility to use a mobile number instead of their bank account data, which reduces friction at the point of sales.

Additionally, payment initiation services offer merchants more options when collecting payments from consumers and business payers. In essence, with this service in place, merchants can cut down on costs, improve payment flows, and offer customers more convenience in the way they pay. On top of that, transactions settle instantly, compared to the average time of a few days for other types of transactions, such as credit cards.

Benefits for consumers

A PISP lets consumers pay companies directly from their bank account rather than using their debit or credit card through card networks. Consumers do not have to remember and input a card number, and they enjoy improved security, as their payment credentials are no longer stored with the merchant. This helps in avoiding a complex online checkout procedure because customers do not have to enter their card number for every purchase, but rather make use of their online banking login.

Benefits for businesses

For businesses, one of the most important benefits is that a PISP can improve the cash flow, ensuring better liquidity. The collection of cash generally takes up to a few days after the online card transaction is initiated, while PISPs can credit corporates’ accounts instantaneously (SCT Inst) or in maximum one business day (SEPA Credit Transfer Classic).

Read the second part of the series to learn more about the benefits AIS bring to merchants, businesses, and end-consumers. Moreover, make sure you check the last part of this series on how we, at ibanXS, can help you reap the benefits of AIS and PIS.