How we work

Before delving into the benefits we bring in the PIS and AIS space, you can read more about the advantages that PIS and AIS bring to merchants, businesses, and end-consumers in the first two parts of the series.

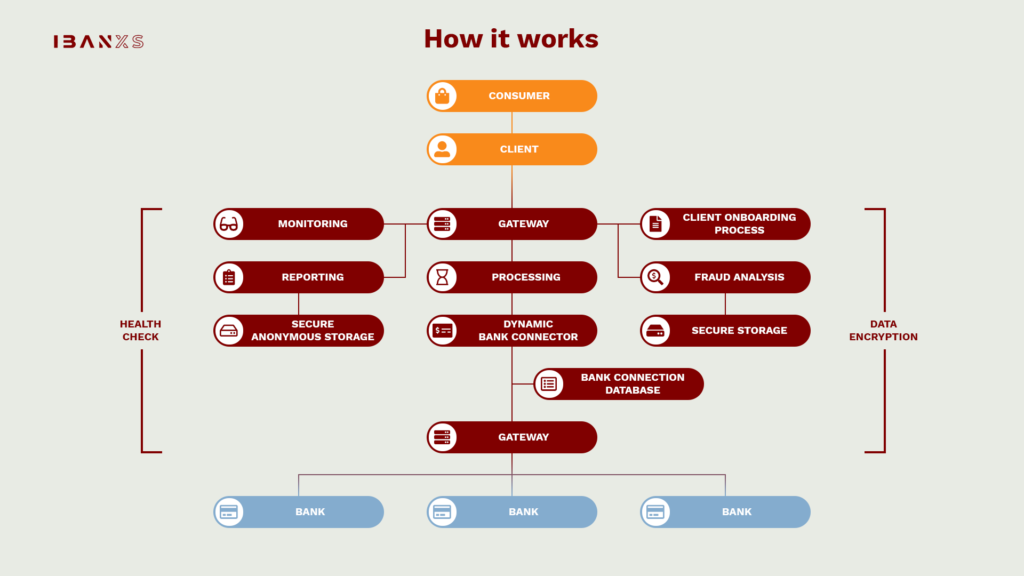

At ibanXS, we help in initiating online and mobile payments to businesses or consumers directly from the payer’s bank account. We facilitate and maintain the connection with any European bank with which our clients want to connect. With our platform, our clients are able to access payment initiation services and account information services. More specifically, we help you:

Payment transfers are initially based on SEPA credit transfers. As soon as a connected bank starts offering instant payments, this will be the designated payment transfer method. This allows each authorized payment transfer to reach the beneficiary bank within 5-10 seconds. Through access to the bank account, the account holder is able to share the history of his/her transactions and identity information validated by his/her bank. What is important mentioning is that the access to the account always starts with the bank account holder’s consent. Our platform registers the consent, and whenever the consent expires, we redirect the customer to their bank environment to provide renewed consent.

The reach of banks is very important, especially for merchants: the more banks they are connected with, the more consumers they can reach. As the multitude of payment methods merchants need to handle is already a pain point, a solution that helps them connect with as many banks as possible is undeniably an attractive proposition.

Conclusion

The financial services space is swiftly turning to a more consumer-centric approach, and any industry player that wants to reap the benefits of PIS and AIS needs to have a solution in place to connect to as many banks as possible, to gain the most out of it. Thanks to PSD2 and Open Banking, we will continue to see the rollout of many other value-adding products and services that challenge the status quo, placing the consumer in pole position. Both services, PIS and AIS, will need a platform capable of connecting and maintaining the connection to the bank interfaces in any market, regardless of their technical specifications for integration. We are the type of partner you are looking for, so if you want to hear more about accessing any European bank you like, contact us at hello@ibanXS.eu.